Construction businesses must https://azbigmedia.com/real-estate/commercial-real-estate/construction/how-to-leverage-construction-bookkeeping-to-streamline-financial-control/ navigate complex tax regulations, including deductions for materials, equipment depreciation, and subcontractor payments. Ensuring compliance with these laws can be time-consuming and requires careful attention to detail. These projects require careful cost management due to fluctuating material prices and changing project scopes. Keeping track of change orders, client payments, and material expenses ensures accurate profitability analysis and avoids disputes over billing. Record wages, tax deductions, and benefits to ensure compliance with labor laws and avoid penalties. Construction businesses must navigate a range of industry-specific regulations, including bonding, licensing, and insurance requirements.

- Small and medium-sized businesses (SMBs) often find it difficult to keep their financial reports in order.

- Their customized solutions and proactive approach ensure that clients can focus on successful project execution while maintaining robust financial health.

- Sage 300 is as comprehensive as it gets with prebuild reports; there are more than 1,400 to choose from.

- Effective bookkeeping services focus on tracking financial data for individual projects, such as labor, materials, and subcontractor costs.

- Once you’ve planned a project, manage it with the general ledger (GL) and payroll features.

- A bookkeeper experienced with such software can provide more accurate and streamlined services.

- Merritt Bookkeeping simplifies financial management for construction and contracting businesses with a flat-rate service of $190 per month.

Best for Real Estate Management

By following these essential The Significance of Construction Bookkeeping for Streamlining Projects tips, general contractors can maintain organized and accurate financial records, allowing them to make informed business decisions. Whether it’s tracking expenses, setting aside money for taxes, or preparing for growth, keeping your finances in order is key to success in the construction industry. For those looking for expert assistance, Meru Accounting offers specialized construction bookkeeping services to help manage your finances, ensuring that your business stays on the right track.

Thank you for contacting Monthend!

A growing business requires financial systems that can handle increased transaction volume and complexity. Expert bookkeeping services help you establish scalable accounting systems and tools, such as advanced construction-specific software. These systems can track multiple projects simultaneously, account for various types of expenses, and handle the complexity of job costing and labor tracking. As you take on more projects or expand your team, these systems allow you to manage growth without sacrificing accuracy or efficiency in financial reporting. One of the most common mistakes in construction bookkeeping is improper job costing. Failing to track all expenses related to individual projects, including materials, labor, subcontractors, and overhead costs, can result in inaccurate financial reports.

How Construction Bookkeeping Impacts Profit Margins

Tapping into your business’ data can help improve safety measures and lead to refined operations, better project delivery, a stronger competitive advantage, and ultimately more project wins. Setting rates or establishing caps for equipment inventory can help monitor cost accumulation and keep projects on budget. Improving the efficiency and effectiveness of your equipment program can also help boost profits and your bottom line. Boost your cash flow by navigating the complex tax credit claims process with our R&D Tax Credits, Federal and State Hiring Credit Services, and more. Construction companies should use a percentage-of-completion method that recognizes both revenue and expenses as they are accumulated over time. It aligns with the project completion ratio and most lenders or guarantors require this.

How to Choose the Best Bookkeeping Services for Your Construction Business

They provide detailed financial records and insights to improve bidding processes and financial health. We’ve built a suite of construction specific financial tools that streamline transaction processing, automate revenue recognition and WIP adjustments, and surface cash flow insights. A suite of construction specific financial tools that streamline transaction processing, automate revenue recognition and WIP adjustments, and surface cash flow insights. Construction businesses can take advantage of various tax deductions, such as those for equipment purchases or project-related expenses.

These experiences enriched her understanding of small business management and marketing strategies. Today, she channels this first-hand knowledge into her articles for Forbes Advisor. QuickBooks Desktop Enterprise free trial includes all the features of each of the three subscription plans. Although QuickBooks Enterprise is a popular accounting software program, it is not the only one on the market.

Get live expertise

- In terms of features, QuickBooks Enterprise is about as close as you can get to an ERP without making the switch to full-on business management software.

- Existing QuickBooks Desktop Pro, Premier, Mac, or Enhanced Payroll users will not be impacted.

- QuickBooks Online offers an incredible number of features and automations.

- If you want cloud-based software, there’s QuickBooks Online and QuickBooks Solopreneur.

If you need accounting features, you can explore more QuickBooks plans to find the right fit for your business. QuickBooks Money is a financial management tool for one-person businesses who need an all-in-one payments and banking solution. It’s free to open, with no monthly fees or minimum balance requirements, giving solopreneurs and freelancers control of their money from anywhere. In addition to the features offered by the Gold and Platinum plans, QuickBooks Enterprise Diamond adds Assisted Payroll and QuickBooks Time Elite.

One drawback to the software is that each plan at these price points is limited to one user. However, while pricing will increase, the Premium plan allows for up to five users while the Quantum allows for up to 40. All of these small costs can add up, making your end bill higher than the predictable $35-$235/month fee.

QuickBooks Pro Plus + Payroll

A Salesforce CRM Connector is available for this plan for an additional monthly fee and setup fee. Note, each QuickBooks Live offering requires an active QuickBooks Online subscription and additional terms, conditions, limitations and fees apply. For more information about services provided by Live Bookkeeping, refer to the QuickBooks Terms of Service. Live Expert Assisted doesn’t include cleanup of your books or a dedicated bookkeeper reconciling your accounts and maintaining your books for you. Live Expert Assisted also doesn’t include any financial advisory services, tax advice, facilitating the filing of income or sales tax returns, creating or sending 1099s, or management of payroll. QuickBooks what is accrued payroll definition and example Desktop Enterprise has the same great accounting capabilities as Pro and Premier but allows access for up to 40 users and much more storage space.

The Complete QuickBooks Versions Comparison Guide

When purchasing QuickBooks Desktop Pro, there are several additional fees to be aware of. Intuit isn’t always very forthcoming with these add-ons and fees, so we wanted to share them. In the next few sections, we’ll cover the pricing structures of QuickBooks Pro, Premier, and Enterprise in more detail. We’ll also discuss the features of each product and guide you on how to choose the right QuickBooks Desktop edition for your business. Banking services provided by our partner, Green Dot Bank, Member FDIC.

You can request a callback anytime when you need a little extra help. Yes, you are employee loans a good idea can upgrade to another plan from any version of QuickBooks Online. Use the apps you know and love to keep your business running smoothly.

QuickBooks Online is one of the company’s most popular accounting software choices for small-business owners. QuickBooks Online pricing is based on a monthly subscription model, and each plan includes a specific number of users. First-time QuickBooks Online users can typically receive a free 30-day trial or a discount for the first few months of service. Users can switch plans or cancel without having to pay termination fees. Live customer support is available by online chat and callback weekdays during extended business hours and on Saturdays. QuickBooks Enterprise is an all-in-one business software that offers a comprehensive suite of features including accounting, inventory management, reporting and industry-specific solutions.

QuickBooks offers a customizable experience in order to evolve as your business demands grow or shift. Hopefully, knowing the exact costs of QuickBooks Online will ease your mind and help you create a more realistic business invoicing best practices budget. If you want to learn more about QuickBooks, read our complete QuickBooks Online review or get started with a free trial. At the end of the day, the cost of QuickBooks Online depends on your business’s needs, and the cost of QuickBooks doesn’t stop at just $35/month for most businesses. Intuit typically offers deals where new users can get a discount on QuickBooks Payroll by bundling it with a QuickBooks Online subscription. QuickBooks Online has over 750 integrations to choose from, including common software programs, such as Shopify, Gusto, and Mailchimp.

What Is Payroll Accounting?

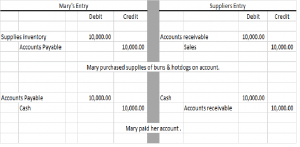

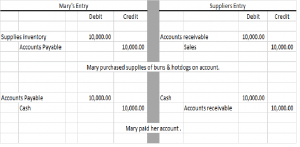

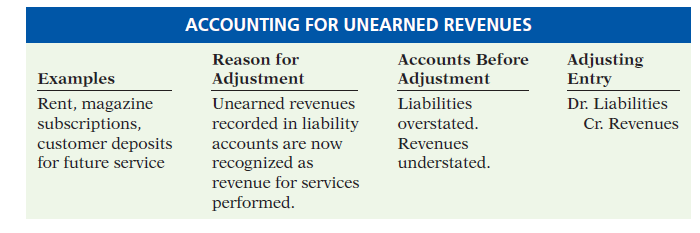

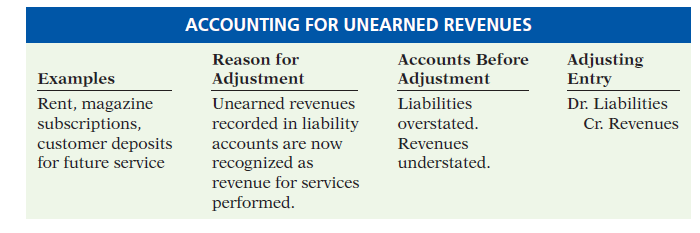

As a result, the employer must remit to the federal government 2.9% of its employees’ wages and salaries. Fees earned from providing services and the amounts of merchandise sold. Under the accrual basis of accounting, revenues are recorded at the time of delivering the service or the merchandise, even if cash is not received at the time of delivery. An accounting method wherein revenues are recognized when cash is received and expenses are recognized when paid. The cash basis of accounting is usually followed by individuals and small companies, but is not in compliance with accounting’s matching principle.

What do you mean by payroll accounting?

Small businesses often handle their payrolls using cloud-based software. Other companies choose to outsource their payroll functions or invest in an integrated ERP system that manages the overall accounting and payroll. A drawback is that companies must rely on individuals outside the business for accurate accounting when they outsource their payroll systems. The company’s on-site personnel must deal with upset employees in the event of errors.

Her expertise is in personal finance and investing, and real estate. Offer health, dental, vision and more to recruit & retain employees. For the past 52 years, Harold Averkamp (CPA, MBA) hasworked as an accounting supervisor, manager, consultant, university instructor, and innovator in teaching accounting online. He is the sole author of all the materials on AccountingCoach.com.

The income statement is also referred to as the profit and loss statement, P&L, statement of income, and the statement of operations. The income statement reports the revenues, gains, expenses, losses, net income and other totals for the period of time shown in the heading of the statement. If a company’s stock is publicly traded, earnings per share must appear on the face of the income statement. The accounting method under which revenues are recognized on the income statement when they are earned (rather than when the cash is received).

If the revenues earned are a main activity of the business, they are considered to be operating revenues. If the revenues come from a secondary activity, they are considered to be nonoperating revenues. For example, interest earned by a manufacturer on its investments is a nonoperating revenue.

- You pay unemployment taxes, both federal and state (if applicable), separately from the taxes shown in Journal 2 and Journal 3.

- Their company pays employees every two weeks for a total of 26 pay periods.

- The accounting method under which revenues are recognized on the income statement when they are earned (rather than when the cash is received).

- The business is responsible for submitting both the employee’s and the company’s contributions to Social Security and Medicare.

- Whether you’ve started a small business or are self-employed, bring your work to life with our helpful advice, tips and strategies.

Set Up Recurring Payments

Then employees receive their paychecks for that pay period on January 17. Until you pay employees, those what’s the difference between book value vs. market value wages are a liability because it’s money you owe. Journal 1 shows the employee’s gross wages ($1,200 for the week). After subtracting some of the most common payroll taxes, the employee’s wages payable or “take-home” pay is $925. Their company pays employees every two weeks for a total of 26 pay periods. Investopedia conducted a review of payroll management and accounting software for small businesses and evaluated their cost, ease of use, features, integrations, and scalability.

Cash Flow Statement

You can also better understand employee costs by tagging expenses and running reports, and breaking down expenses by category. Liabilities often have the word “payable” in the account title. Liabilities also include amounts received in advance for a future sale or for a future service to be performed. Insurance often required by states and paid for by the employer to compensate workers who were injured on the job. The amount of the insurance premiums vary by type of work performed. For example, rates are higher for new rules for reporting tax basis partner capital accounts operators of machinery and are lower for office employees.

If you want to learn more about the Percentage Method, you can read all about it and the wage bracket methods in IRS Publication 15-T. A garnishment is a legal process in which one person (the garnishee) bookkeeping for large business is ordered to withhold money due to another person and to pay the money held over to a third party. So for example, if A owes money to B, then C can be instructed to hold money due to A, and to pay the money withheld over to B.

Payroll accounting provides you with a record of tax obligations and legal obligations. This means you know whether your organization is compliant with tax laws imposed by the local, state and federal government, so you can avoid expensive penalties and tax audits. Plus, employees will also be able to track the amount of their compensation allotted for tax obligations. They pay 6.2% of your income amount toward Social Security and 1.45% of your income amount toward Medicare so the government gets a total of 15.3% of your total income for these two taxes. Another disadvantage is that payroll services are more expensive than running payroll in-house.

Construction bookkeeping: everything you need to know

Explore seven transformative applications and discover how is AI used in businesses for efficiency and innovation. QuickBooks for Construction comes in at the best value of all the options on our list. You can get the Plus plan for $49.50 per month for the first three months when it bumps up to $99 per month. The Advanced plan is available for $117.50 per month for the first three months before increasing to $235 per month. Manage employees with a built-in time clock and store photos, videos and documents in the system for easy access. The first is the Essential plan starting at $199 for the first month, which then moves up to $499 per month.

Understanding Construction Bookkeeping Tax Liabilities:

- Project costs vary according to the weather and season in which work is due to take place, as do the cost of materials and strain on workers and equipment.

- With accurate construction accounting, companies can better manage their liquidity and prepare for cash shortages.

- They’ll provide guidance, answer your questions, and teach you how to do tasks in QuickBooks, so you can stay on track for tax time and run your business with confidence.

- However, the more projects you have on the go and the more people that work for you, the more you need to have a reliable bookkeeping process.

- Accurate financial reporting is guaranteed by construction bookkeeping software, which eliminates human mistakes.

- Compliance with wage laws ensures that workers are paid fairly and on time, which not only fosters a positive work environment but also protects the company from potential legal disputes.

- This helps you identify potential issues or delays early on and adjust your plans accordingly before they become bigger problems that could impact the project’s outcome.

Our primary goal as a trusted advisor is to be available and to provide insightful advice to enable our clients to make informed financial decisions. We do not accept anything less from ourselves and this is what we deliver to you. Accurate record-keeping of project-related expenses is made possible by bookkeeping. This allows project managers to spot when things aren’t going according to plan. Because of all the variables, records can be misplaced or not recorded in the books properly. The construction sector is vulnerable to the effects of governmental and economic policies.

Best for Mobile Use

Trusted by over 400 cloud customers, including 30+ billion-dollar companies, CMiC helps contractors optimize productivity, reduce gross vs net risk, and drive financial growth. Its robust platform provides seamless integration, superior project delivery, and enhanced collaboration. With proven workflows and industry-specific functionality, CMiC’s payroll management for contractors empowers construction teams to manage resources, accounting, and payroll efficiently. Construction companies typically use accrual accounting and job cost accounting.

Record daily transactions

If your business bookkeeping services for homebuilders has any unique bookkeeping needs, you’ll want to look for a solution that caters to those needs as well. If you decide to hire an accountant, look for one with experience in your industry because they’ll know how to handle your company’s accounting needs most effectively. Hiring an accountant to take care of your bookkeeping can save you a significant amount of time, as well as eliminate bookkeeping and accounting errors.

It will ensure you have capital in the event that a customer withholds money owed. The high price and length of construction projects make payment scheduling and collection unique. Compliance with wage laws ensures that workers are paid fairly and on time, which not only fosters a positive work environment but also protects the company from potential legal disputes. This includes adhering to minimum wage standards, overtime pay regulations, and specific provisions related to prevailing wages in government contracts. Construction bookkeeping presents unique challenges that can complicate financial management. Understanding these hurdles and how to address them can significantly improve accuracy and efficiency.

Grow with QuickBooks construction accounting software

This report is crucial for maintaining cash flow, a common challenge in the construction industry. Furthermore, project status reports offer real-time updates on project https://www.bookstime.com/articles/accounting-for-architects progress and financial standing, enabling contractors to make informed decisions quickly. Regular financial reporting that includes detailed profit and loss statements, cash flow reports, and job-specific financials helps construction companies make data-driven decisions.

Revenue Recognition in Construction Accounting

As such, effectively managing accurate Work in Progress (WIP) is a crucial component of construction project accounting. Financial reports like job cost reports, revenue recognition methods, and various statements help contractors make informed decisions, optimize project performance, and maintain financial stability. Embracing construction accounting principles empowers companies to manage risks, seize growth opportunities, and achieve success in the competitive construction industry. This error not only leads to misleading financial reports but also hampers decision-making. Without a clear understanding of which costs are impacting profitability, it’s difficult to make informed business decisions.

- Construction bookkeeping services like software make expense recording easier, though some opt for recording bills in a comprehensive journal.

- Key features include project costing, CRM, inventory, and payroll, all within an integrated platform designed for construction firms.

- Many construction companies use a “completion percentage” approach, meaning they calculate estimated taxes based on quarterly income and expense reports.

- Remote Books Online provide first month bookkeeping services for free for your books and will do documentation all transactions and essential journal entries.

- The simplest way to account for retainage is to include two sets of information on your invoices.

- For contractors, having robust bookkeeping practices helps maintain profitability and control over each project.

Labor costs include the wages or salaries of the workers who will be involved in the project, as well as any benefits or incentives. Equipment costs include renting or purchasing machinery, vehicles, or other specialized tools needed during the project. Permits are required for some types of work and often come with fees, so it’s important to factor these into the budget. Familiarize yourself with contractor tax forms that are relevant to your business, such as Form 1099-NEC for nonemployee compensation and Form W-2 for employee wages. Gaining a thorough understanding of these forms and filing them accurately and timely is essential to stay compliant with tax regulations. Regularly reconcile your bank and credit card statements with your financial records to catch errors early and maintain accuracy.

How to Create Opening and Closing Entries in Accounting

Temporary accounts differ from permanent accounts, which do not need to be opened and closed each period as they show the accounting ongoing financial position of a business. Temporary accounts can be found on the income statement, while permanent accounts are located on the balance sheet. The end result is equally accurate, with temporary accounts closed to the retained earnings account for presentation in the company’s balance sheet.

Step 2: Close all expense accounts to Income Summary

In a computerized accounting system, the closing entries are likely done electronically by simply selecting “Closing Entries” or by specifying the beginning and ending dates of the financial statements. As a result, the temporary accounts will begin the following accounting year with zero balances. Notice how only the balance in retained earnings has changed and it now matches what was reported as ending retained earnings in the statement of retained earnings and the balance sheet. Companies are required to close their books at the end of eachfiscal year so that they can prepare their annual financialstatements and tax returns.

- If your business uses automatic software to manage your financial needs, it will not use an income summary account to shift these temporary account balances.

- The net income (NI) is moved into retained earnings on the balance sheet as part of the closing entry process.

- The next day, January 1, 2019, you get ready for work, but before you go to the office, you decide to review your financials for 2019.

- This balance is then transferred to the RetainedEarnings account.

Closing Entry for Expense Account

Failing to make a closing entry, or avoiding the closing process altogether, can cause a misreporting of the current period’s retained earnings. It can also create errors and financial mistakes in both the current and upcoming financial reports, of the next accounting period. Let’s investigate an example of how closing journal entries impact a trial balance.

Do you own a business?

In summary, the accountant resets the temporary accounts to zero by transferring the balances to permanent accounts. Closing entries are journal entries used to empty temporary accounts at the end of a reporting period and transfer their balances into permanent accounts. Temporary accounts are used to accumulate income statement activity during a reporting period. The use of closing entries resets the temporary accounts to begin accumulating new transactions in the next period.

Everything to Run Your Business

So, even though the process today is slightly (or completely) different than it was in the days of manual paper systems, the basic process is still important to understand. Temporary accounts are income statement accounts that are used to track accounting activity during an accounting period. For example, the revenues account records the amount of revenues earned during an accounting period—not during the life of the company.

Great! The Financial Professional Will Get Back To You Soon.

- The fourth entry requires Dividends to close to the RetainedEarnings account.

- These accounts were reset to zero at the end of the previous year to start afresh.

- As you will see later, Income Summary is eventually closed to capital.

- The $10,000 of revenue generated through the accounting period will be shifted to the income summary account.

- Temporary accounts differ from permanent accounts, which do not need to be opened and closed each period as they show the ongoing financial position of a business.

To close revenue accounts, you first transfer their balances to the income summary account. Start by debiting each revenue account for its total balance, effectively reducing the balance to zero. Then, credit the income summary account with the total revenue amount from all revenue accounts. If dividends were not declared, closing entries would cease at this Food Truck Accounting point. If dividends are declared, to get a zero balance in the Dividends account, the entry will show a credit to Dividends and a debit to Retained Earnings. As you will learn in Corporation Accounting, there are three components to the declaration and payment of dividends.

Step 2 of 3

By leveraging automated systems, businesses can ensure that all tasks related to closing entries are handled seamlessly, reducing manual effort and minimizing errors. Once we have made the adjusting entries for the entire accounting year, we have obtained the adjusted trial balance, which reflects an accurate and fair view of the bakery’s financial position. Companies are required to close their books at the end of each fiscal year so that they can prepare their annual financial statements and tax returns. In this chapter, we complete the final steps (steps 8 and 9) of the accounting cycle, the closing process. You will notice that we do not cover step 10, reversing entries.

Ready to Experience the Future of Finance?

- Note that by doing this, it is already deducted from Retained Earnings (a capital account), hence will not require a closing entry.

- Journal entries are an essential part of the accounting process for any business.

- Once this is done, it is then credited to the business’s retained earnings.

- It is a holding account for revenues and expenses before they are transferred to the retained earnings account.

If you put the revenues and expenses directlyinto retained earnings, you will not see that check figure. Nomatter which way you choose to close, the same final balance is inretained earnings. Notice that the effect of this closing journal entry is to credit the retained earnings account with the amount of 1,400 representing the net income (revenue – expenses) of the business for the accounting period. Closing entries are a necessary part of the accounting cycle as they allow businesses to generate financial statements and file tax returns every month and year accurately.

This is an optional step in the accounting cycle that you will learn about in future courses. Steps 1 through 4 were covered in Analyzing and Recording Transactions and Steps 5 through 7 were covered in The Adjustment Process. Let’s move on to learn about how to record closing closing entries those temporary accounts.

Create and Send Invoices OnlineA seasoned small business and technology writer and educator with more than 20 years of experience, Shweta excels in demystifying complex tech tools and concepts for small businesses. Her work has been featured in NewsWeek, Huffington Post and more. Her postgraduate degree in computer management fuels her comprehensive analysis and exploration of tech topics. The date on the top of the invoice should be the https://spartak-ks.ru/kak-izmenilos-lico-lvova-za-gody-nezavisimosti/ date the invoice was generated. The dates under the ‘description’ should be when the product was delivered or the service was performed. Sign up to receive more well-researched small business articles and topics in your inbox, personalized for you.

Add a professional header

- This starts with a conversation between you and the customer to determine which elements of the invoice the customer disagrees with.

- Email is the most frequently used and fastest way of sending an invoice to someone.

- Photography services can be a large investment for your clients, so it’s important to provide a clear description and cost breakdown of all of your services.

- As discussed, we’ve applied a bulk discount of percentage% to the total cost, bringing the amount due to discounted amount.

- The best practice is to notify customers first that the work is done from your end and verify all the details.

A free invoice template makes your professional life easier by getting you paid much faster, saving you time, and increasing your productivity. Contracts signed by both parties can act as legal documents, reduce the chance of misunderstandings about transactions, and help speed up the payment process. Invoices are essential tools that business owners can use to keep accurate sales records, create paper trails, and ensure prompt payment in full from customers. Past due invoices can impact cash flow, and collecting overdue invoices can cost business owners time and energy. Writing clear invoices that are easy to understand may help reduce the risk of an invoice being past due. Typically sent at the end of a project, the final invoice documents that the business has upheld its end of the deal https://www.kinospace.ru/movie/395792 and payment is due.

What are invoices used for?

A discussion on http://russkialbum.ru/tags/Build/page/7/ how to send an invoice would be incomplete without discussing the next steps. Sequential invoice numbers make it easy to stay consistent and ensure you never assign duplicate invoice IDs. Invoices are sometimes confused with purchase orders, but these documents serve different purposes.

Common mistakes to avoid

- The longer you wait after providing goods or services to send the invoice, the longer it will take you to get paid.

- If you’d prefer a handwritten signature, you can delete the placeholder signature in Visme’s invoice editor, and leave the space blank before downloading and printing.

- This one features large lines, easy-to-read forms, and complementary colors, which make it fun and practical to use, although it may not be suited for every brand.

- When selling products or services, enter the invoice amount owed as accounts payable on the buyer’s end, and for a business, the invoice is in accounts receivable.

Stripe can act as the first line of defense to help you eliminate unpaid invoices. Automatically send email reminders when invoices are due or past due, and use Smart Retries to retry failed payment attempts at optimized times. Stripe’s online invoices are optimized across mobile, tablet, and desktop.

Send an invoice after purchase

She has years of experience in content strategy and execution, SEO copywriting and graphic design. She is also the founder of MASH Content and is passionate about tea, kittens and traveling with her husband. If you’d prefer a handwritten signature, you can delete the placeholder signature in Visme’s invoice editor, and leave the space blank before downloading and printing. However, you can easily modify it with your own colors and fonts for your own business.

If you have an approval process in place, such as requiring a manager’s signature, do so before the invoice is approved for payment. Accounts payable helps you keep accurate records of your business transactions, which is important for tax purposes. AP ledgers should be regularly reconciled with statements from suppliers at least once a month.

Step 3: Entering invoices into your accounting system

This is the number of days it takes a company, on average, to pay off their AP balance. Companies mostly find it convenient to record an accounts payable liability when they actually receive the goods. However, in certain situations, the title to goods passes to the buyer before the physical delivery is taken by him. In such situations, the liability should be recorded at the time of passage of title. The formula can be modified to exclude cash payments to suppliers, since the numerator should include only purchases on credit from suppliers. An aging schedule separates accounts payable balances, based on the number of days since the invoice was issued.

Payment terms may include the offer of a cash discount for paying an invoice within a defined number of days. For example, 2%, Net 30 terms mean that the payer will deduct 2% from the invoice if payment is made within 30 days. Accounts payable (also known as creditors) are balances of money owed to other individuals, firms or companies. These are short term obligations which arise when a sole proprietor, firm or company purchases goods or services on account. Accounts payable usually appear as the first item in the current liabilities section of a company’s balance sheet. A trade payable is an amount billed to a company by its suppliers for goods delivered to or services consumed by the company in the ordinary course of business.

How to improve your accounts payable process

The department is also a key driver in supporting the organization as a whole when it comes to vendor payments, approvals, and reconciliations. If your supplier has determined that you are a credible customer, you may receive early payment discounts on your accounts payable. This means while you’re receiving a discount on your accounts payable, you can give a discount on google adwords fundamentals april 2018 flashcards your accounts receivable to customers that make early payments.

Further, the clerk undertakes the processing, verifying, and reconciling the invoices. Also, he pays suppliers by scheduling pay checks and ensures that payment is received for outstanding credit. Say, for instance, you receive invoices from your suppliers, these supplier invoices would be recorded as credits to your accounts payable account.

Benefits of accounts payable automation

Accrual accounting requires firms to post revenue when earned and expenses when incurred to generate revenue. All businesses should use accrual accounting so that revenue can be matched with expenses, regardless of the timing of cash flows. Financial statements also include current assets, which include cash and balances that will be paid within 12 months.

- You need to make your accounts payable process efficient so that it provides a competitive advantage to your business.

- The accounts payable (AP) department is responsible for implementing the entire accounts payable process.

- In either case, there must be a firm requirement for the recipient to immediately forward the invoice to the payables department.

- Therefore, accounts payable appears on the liability side of your balance sheet, under current liabilities.

- When the balance sheet is drawn, the balance shown by this account is reported as current liability.

Process Payment

Each time a company purchases goods or services on account, it records an accounts payable liability in its books of accounts. The measurement of accounts payable liability involves no complications, as the seller’s invoice shows the exact amount that the buyer needs to pay within a specified date. Accounts payable are considered a source of cash, since they represent funds being borrowed from suppliers. Given these cash flow considerations, suppliers have a natural inclination to push for shorter payment terms, while creditors want to lengthen the payment terms.

However, it is also important to extend trade credit in the form of accounts receivable to sell goods to your customers. As accounts payable are deemed short-term obligations of your business towards its creditors or suppliers, these obligations will need to be met in less than a year. Therefore, accounts payable appears on the quickbooks desktop community liability side of your balance sheet, under current liabilities. Since you’ve purchased goods on credit, the accounts payable is recorded as a current liability on your company’s balance sheet. The debit offset for this entry generally goes to an expense account for the good or service that was purchased on credit.

Alternatively, if there are few payables, they may be recorded directly in the general ledger. Accounts payable appears within the current liability section of an entity’s balance sheet. When confirming accounts payable, your company’s auditors must take a sample of accounts payable. These majorly represent your business’s purchasing or borrowing activities. Further, special emphasis must be given to accounts payable representing larger transactions. Once the sample invoices clearing account are reviewed, each of them must be confirmed and verified.

Debt-to-Equity D E Ratio Formula and How to Interpret ItThe total debt-to-total assets formula is the quotient of total debt divided by total assets. As shown below, total debt includes both short-term and long-term liabilities. Using this metric, analysts can compare one company’s leverage with that of other companies in the same industry.

What Are Some Common Debt Ratios?

This will determine whether additional loans will be extended to the firm. In the consumer lending and mortgage business, two common debt ratios used to assess a borrower’s ability to repay a loan or mortgage are the gross debt service ratio and the total debt service ratio. It’s great to compare debt ratios across companies; however, capital intensity and debt needs vary widely across sectors. The financial health of a firm may not be accurately represented by comparing debt ratios across industries. Bear in mind how certain industries may necessitate higher debt ratios due to the initial investment needed. When evaluating a business, the debt to asset ratio states how much of your expenses were paid for with credit, loans, or any other form of debt.

What Is the Current Ratio?

Since interest is usually a fixed expense, leverage magnifies returns and EPS. This is good when operating income is rising, but it can be a problem when operating income is under http://vasilisc.com/snappy-snapcraft-interfaces pressure. There are several forms of capital requirements and minimum reserve placed on American banks through the FDIC and the OCC that indirectly impact leverage ratios.

Is a Low Total Debt-to-Total Asset Ratio Good?

- The debt-to-total-assets ratio is important for companies and creditors because it shows how financially stable a company is.

- Creditors, on the other hand, want to see how much debt the company already has because they are concerned with collateral and the ability to be repaid.

- It’s great to compare debt ratios across companies; however, capital intensity and debt needs vary widely across sectors.

- The debt ratio defines the relationship between a company’s debts and assets, and holds significant relevance in financial analysis.

Understanding the debt to asset ratio is a key part of a company staying afloat financially. It tells you how well a business is performing financially and if it can afford to continue or needs revaluation. The debt to asset ratio creates a picture of the debt percentage that makes up an asset portfolio. It is important to evaluate industry standards and historical performance relative to debt levels. Many investors look for a company to have a debt ratio between 0.3 (30%) and 0.6 (60%). The debt-to-asset ratio indicates the capacity to fulfill long-term debts.

While a lower calculation means a company avoids paying as much interest, it also means owners retain less residual profits because shareholders may be entitled to a portion of the company’s earnings. One shortcoming of the total debt-to-total assets ratio is that it does not provide any indication https://best-stroy.ru/docs/r103/1767 of asset quality since it lumps all tangible and intangible assets together. Common debt ratios include debt-to-equity, debt-to-assets, long-term debt-to-assets, and leverage and gearing ratios. The higher the debt ratio, the more leveraged a company is, implying greater financial risk.

Leverage can thus multiply returns, although it can also magnify losses if returns turn out to be negative. She adds together the value of her inventory, cash, accounts receivable, and the result is $26,000. Pete Rathburn is a copy editor and fact-checker with expertise in economics and personal finance and over twenty years of experience in the classroom. For example, a company might determine that ceasing to offer a particular product or service would be in their best long-term interest. Let’s see some simple to advanced http://a3print.ru/printer/214/168/index.html example to understand them better. My Accounting Course is a world-class educational resource developed by experts to simplify accounting, finance, & investment analysis topics, so students and professionals can learn and propel their careers.

A debt to asset ratio below one doesn’t necessarily tell the tale of a thriving business. If an organization has a debt to asset ratio of 0.973, 97.3% of it is covered on borrowed dollars. Christopher should seek immediate action towards remedying the situation, such as hiring a financial advisor to help. If he doesn’t do anything to alter the trajectory of his company’s finances, it will go bankrupt within the next couple of years.

The Debt/EBITDA Ratio and Credit Ratings

Creditors get concerned if the company carries a large percentage of debt. Analysts, investors, and creditors use this measurement to evaluate the overall risk of a company. Companies with a higher figure are considered more risky to invest in and loan to because they are more leveraged. This means that a company with a higher measurement will have to pay out a greater percentage of its profits in principle and interest payments than a company of the same size with a lower ratio.

- All else being equal, the lower the debt ratio, the more likely the company will continue operating and remain solvent.

- As you can see, the values of the debt-to-asset ratio are entirely different.

- If the debt-to-asset ratio is exceptionally high, it indicates that repaying existing debts is already unlikely, and further loans are a high-risk investment.

- The business owner or financial manager has to make sure that they are comparing apples to apples.

In order to perform industry analysis, you look at the debt-to-asset ratio for other firms in your industry. Basically it illustrates how a company has grown and acquired its assets over time. Companies can generate investor interest to obtain capital, produce profits to acquire its own assets, or take on debt.

Artificial intelligence AI in finance

These tasks, which once required significant manual effort and time, can now be completed quicker and more accurately by automation, freeing up employees to focus on higher value tasks and more strategic activities. Traditionally, financial processes, such as data entry, data collection, data verification, consolidation, and reporting, have depended heavily on manual effort. All of these manual activities tend to make the finance function costly, time-consuming, and slow to adapt. At the same time, many financial processes are consistent and well defined, making them ideal targets for automation with AI. Trained machine learning models process both current and historical transactional data to detect money laundering or other bad acts by matching patterns of transactions and behaviors. GenAI can fill out the needed forms with data provided by the finance team for the staff to review and confirm.

Additionally, Entera can discover market trends, match properties with an investor’s home and complete transactions. Socure created ID+ Platform, an identity verification system that uses machine learning and AI to analyze an applicant’s online, offline and social data, which helps clients meet strict KYC conditions. The system runs predictive data science on information such as email addresses, phone numbers, IP addresses and proxies to investigate whether an applicant’s information is being used legitimately. Socure is used by institutions like Capital One, Chime and Wells Fargo, according to its website. Learn how to transform your essential finance processes with trusted data, AI insights and automation. By establishing oversight and clear rules regarding its application, AI can continue to evolve as a trusted, powerful tool in the financial industry.

Centrally led, business unit executed

- Learn how AI can help improve finance strategy, uplift productivity and accelerate business outcomes.

- Scienaptic AI provides several financial-based services, including a credit underwriting platform that gives banks and credit institutions more transparency while cutting losses.

- AI has given the world of banking and finance new ways to meet the customer demands of smarter, safer and more convenient ways to access, spend, save and invest money.

- AI can even help make pricing personalized, using real-time insights about individual customer preferences, market changes, and competitor activity to optimize price and discounts.

Second, automated financial close processes enable companies to shift employee activity from manual collection, consolidation, and reporting of data to analysis, strategy, and action. Using our own solutions, Oracle closes its introduction to inventories and the classified income statement books faster than anyone in the S&P 500—just 10 days or roughly half of the time taken by our competitors. This leaves our financial team with more time focused on the future instead of just reporting the past. AI refers to the development of computer systems that can perform tasks like humans do.

What is machine learning (ML)?

Workiva offers a cloud platform designed to simplify workflows for managing and reporting on data across finance, risk and ESG teams. It’s equipped with generative AI to enhance productivity by aiding users in drafting documents, revising content and conducting research. The company has more than a dozen offices around the globe serving customers in industries like banking, insurance and higher education. The advent of ERP systems allowed companies to centralize and standardize their financial functions. Early automation was rule-based, meaning as a transaction occurred or input was entered, it could be subject to a series of rules for handling.

Is the ERP vendor’s solution also focused on human improvement? Or is it only focused on process improvement?

This simplifies the customer interaction with banks, reduces overall processing time, and reduces human errors in the process. AI in finance can help reduce errors, particularly in areas where humans are prone to mistakes. High volume repetitive tasks can often lead to human error—but computers don’t have the same issue. Leveraging the advanced algorithms, data analytics, and automation capabilities provided by AI can help identify and correct errors common in areas such as data entry, financial reporting, bookkeeping, and invoice processing. However, that’s merely the start of where finance could implement AI to drive efficiency and productivity.

Companies that take their time incorporating AI also run the risk of becoming less attractive to the next generation of finance professionals. 83% of millennials and 79% of Generation Z respondents said they would trust a robot over their organization’s finance team. Millennial employees are nearly four times more likely than Baby Boomers to want to work for a company using AI to manage finance. Business leaders are excited about generative AI (gen AI) and its potential to increase the efficiency and effectiveness of corporate functions such as finance.

With the increasing complexity of regulatory compliance around the globe, the cost and resource burden of regulatory reporting has soared in recent years. Organizations devote significant time and resources to meeting those requirements. AI can take on a portion of the workload by automating compliance monitoring, audit trail management, and regulatory report creation. Among the financial institutions we federal extension studied, four organizational archetypes have emerged, each with its own potential benefits and challenges (exhibit). The right operating model for a financial-services company’s gen AI push should both enable scaling and align with the firm’s organizational structure and culture; there is no one-size-fits-all answer. An effectively designed operating model, which can change as the institution matures, is a necessary foundation for scaling gen AI effectively.

Second, train staff so they have the skills to effectively interact with AI tools, building analytical capabilities that capitalize on the technology. Giving finance staff increased understanding of AI will also be critical in ensuring the proper security, controls, and appropriate use of the technology. Task automation is an obvious cost reduction tactic, letting companies decrease how to flush alcohol from your system their labor costs, fill workforce gaps, improve productivity and efficiency, and have employees focus on strategic, value-adding activities.

Applying VAT to private school fees

Next, you’ll provide documentation to your state, after which you can apply to take the exam in the state where you’re pursuing licensure. In California, for example, you’ll apply through the California Board of Accountancy and pay a $100 fee as bookkeeping a first-time applicant or a $50 fee for repeat applicants. Consider choosing a per-form payment type over an hourly rate if you only have simple tax returns done annually. When you make the payment of the examination fee detailed in point 3 above, you also need to pay a registration fee. The NASBA website provides state-wise details of the payment that is required to be made. Most states specify that you must have a bachelor’s degree in accounting.

The #1 Resource for CPA Review

Typically, a more experienced CPA with a proven track record in a specific industry will command a higher fee. To schedule a test at an international location, candidates must first apply through a participating U.S. jurisdiction and then choose the international location https://x.com/bookstimeinc during the scheduling process. The testing process is similar to that in the U.S., and candidates must adhere to the same rules and regulations as domestic test-takers.

- Instead, prices depend on factors like the size of your business, the services required, the accountant’s expertise, and the length of time you plan to work with them.

- One of the best-known CPA test prep organizations, Becker offers several options to prepare for the CPA.

- Additionally, you have to be prepared to pay several thousand dollars in fees and costs.

- This is another scenario where most CPA fees will come in the form of a flat rate for each individual filing.

- Most states and territories don’t have minimum age requirements in place.

- You’ll also need to track tasks like calculating capital gains, asset deductions, and fringe benefits tax.

#1: Cost of a CPA Review Course

For example, smaller organizations may have lower audit fees, while larger organizations with more complex financial transactions may have higher fees. These fees may vary, based on the complexity of the individual’s or business’s tax situation and the CPA’s expertise. Small businesses often benefit from using a tax preparer who specializes in this area of tax preparation. Tax professionals may save you money and time, and ensure you are following relevant tax rules for business owners. We always recommend checking with your state’s board of accountancy to ensure you meet the education requirements prior to applying for the CPA Exam.

CPA Exam requirements

Before applying for the CPA Exam, international candidates must ensure that their educational qualifications meet the eligibility requirements set by the chosen U.S. jurisdiction. Since educational systems vary worldwide, international candidates need to have their credentials evaluated by an accredited National Association of Credential Evaluation Services (NACES) member. Most states also need candidates to take an ethics exam covering topics from the AICPA Code of Professional Conduct as part of their CPA license requirements. In most cases, you’re required to pass the open-book ethics exam, how much does a cpa cost often with a score of at least 90%, within a year or two of passing the CPA Exam. All states and jurisdictions require CPAs to have a minimum of a bachelor’s degree and 150 total hours of college education, either at the undergraduate or graduate level. Most states also require a specific number of hours in upper-level accounting and business coursework.

CPAs who specialize in a particular industry, such as healthcare or technology, may also charge a higher rate due to their specialized knowledge and expertise. Each section of the CPA Exam consists of multiple-choice questions, task-based simulations, and a written communication component (BEC section only). You can find a good CPA by asking your family, friends, and colleagues for recommendations. In addition, the IRS publishes a list of tax preparers, and most states have their own CPA societies.

- This is the fee that you pay to your state board in order to apply to take the exam.

- Certified Public Accountants (CPAs) provide a wide range of services, and one key area is tax preparation.

- We help you truly understand the material for improved performance on the CPA Exam and in your career.

- We partner with hundreds of educational institutions, employers, and professional organizations to provide leading CPA review material and accounting resources.

- Accountants can assist in building up an effective accounting system to accurately and conveniently assess profitability, monitor prices and expenses, control budgets, and forecast future speculation trends.

- The CPA exam tests accountants on their knowledge of advanced public accounting and financial reporting procedures.

With the catch-up bookkeeping add-on, Bench’s bookkeepers can provide overdue bookkeeping services—no matter how far you’ve fallen behind on your books. Your bookkeeper will consult with you, find out how much you owe, update your books accordingly on your behalf, and deliver tax-ready financials. Once you’re caught up, Bench will work with you to transition over to monthly ongoing bookkeeping services. The platform is best for freelancers and small businesses with basic bookkeeping needs, such as providing cash-basis financial statements for tax return preparation.

Tax & Consulting Services

Provide higher-level accounting guidance to the Xendoo Accounting team. Bench Accounting offers two monthly subscription plans, Essential for $299 and Premium for $499. If you sign up for an annual contract, the monthly price goes down to $249 for Essential and $399 for Premium. While both offer basic https://www.bookstime.com/ bookkeeping and year-end reporting, Premium has unlimited tax advisory services and federal and state tax filing.

- The Forbes Advisor Small Business team is committed to bringing you unbiased rankings and information with full editorial independence.

- It all depends on how long you have ignored your books, and how messy your records are.

- Review your customer accounts to ensure that you’ve collected all customer invoices for the tax year.

- Properly maintaining your books can help prevent such costly catch-up efforts.

PRICING

Without proper oversight and reconciliation of financial records, unauthorized transactions, duplicate payments, or misappropriation of funds may go unnoticed. Catch up bookkeeping helps identify irregularities or discrepancies in a business’s finances, enabling them to implement internal controls and safeguards to prevent potential financial risks or losses. The Accounting tab on your dashboard provides you with real-time updates of your financials, showing exactly how much money you have and how you’re spending it. You can access your income statement, balance sheet, and other reports that are fully customizable.

Payroll Management

To make taxes more hassle-free, you can upgrade to the Premium tier, which includes unlimited bookkeeping and tax support. Premium also has filing for sole proprietors, contractors, and businesses (S-corps, C-corps, and partnerships). Financial data mismanagement can mean catastrophe for the future of a business. Poor bookkeeping leads to inaccurate reporting, which compromises the integrity and stability of the business. Your business could even incur government penalties due to catch up bookkeeping unfiled transaction records. Bookkeeping is one of the core elements in the growth and success of any business.

Step #6 – Updating financial statements

- Merritt Bookkeeping provides professional remote bookkeeping services to small businesses located anywhere in the US.

- Let a professional sort your books for you and develop a bookkeeping system that will serve you well now and for the future.

- A small business can likely do all its own bookkeeping using accounting software.

- Neglecting bookkeeping tasks can yield significant financial and operational consequences, leading to the accumulation of financial discrepancies and errors.

Compare each transaction from your bank statement with the same cash flow transaction in your company accounting records to ensure the balance of each account is the same. If they aren’t, identify and fix any errors to ensure that the balance in your bank statement matches the balance in your company records. Review your customer accounts to ensure that you’ve collected all customer invoices for the tax year. If your business operates using a cash basis accounting method, you only need to send the customer an invoice once they have paid. If your business uses an accrual basis accounting method, you record the amount in your books the moment the sale occurs, even if you haven’t received the cash yet.

Our offerings range from basic bookkeeping to advanced CFO advisory. Explore our services, discover the benefits of working with us, and learn about why we love Seattle, Washington. MAS Certified Public Accountants is a Seattle business that has been serving individuals and businesses for over nine years.

Not outsourcing payroll? Here’s what you’re missing.

- Whether we provide you with a virtual CFO, fractional CFO, or a combination of the two, Acuity can help you plan for the future with your finances.

- The woman-led team of accountants and tax advisers works with businesses and tailors support packages that reflect their industry-specific needs.

- Finding the right bookkeeping service for your Seattle-based business shouldn’t be difficult.

- Get expert advice to help you run your business with integrity, delivered to your inbox monthly.

- If there’s any change in your bookkeeping team, we’ll let you know as soon as possible and make sure the transition is a smooth one.

- Clients appreciate their knowledge, responsiveness, patience, and skill.

The business offers bookkeeping services and packages are basic bookkeeping, mid-level bookkeeping, and advanced bookkeeping. bookkeeping seattle Overall Office Solutions also offers stand-alone services which include notary services, payroll processing, reconciling, and QuickBooks set-up. Nancy Morelli has more than 20 years of accounting and administrative experience.

Bookkeeping Services In Seattle

1-800Accountant Seattle serves those in the metro and across 50 states who require bookkeeping solutions. The team has local certified public accountants with an average of 17 years of experience. They maintain accurate and detailed transaction records and take on audit defense matters. Tax advisory and payroll services are available, and the crew gets employer identification numbers for new business ventures. 1-800Accountant has amassed more than 100,000 clients and partners with the Florida Justice Association.

We’ve helped more Seattle-based businesses than any other bookkeeping company.

All your monthly bookkeeping bookkeeping tasks are handled for a low fixed monthly rate with no long-term contracts. As a small business owner, you have enough to worry about without having to keep track of your bookkeeping and finances. With Acuity, you have a dedicated team of experts at your disposal, ensuring continuous support and expertise.

Clients appreciate their knowledge, responsiveness, patience, and skill. Unchained Financial Services offers bookkeeping support, tax services, and accounting services to clients in and around Seattle. The woman-led team of accountants and tax advisers works with businesses and tailors support packages that reflect their industry-specific needs. CEO Melissa Guy, EA brings over twenty years of relevant experience. The company networks with other industries, such as website designers, marketers, and insurance agents to help keep startups running. Overall Office Solutions is a Kent business that has been serving small businesses for over seven years.

- Personal services are tax assistance, tax compliance, and financial planning.

- Linda M. Teachout, CPA, PLLC is a Shoreline business that has been serving individuals and businesses in the Greater Puget Sound area for over five years.

- Join hundreds of businesses that rely on us to handle their bookkeeping while you focus on growing your business.

- Clients appreciate their efficiency, reliability, and professionalism.

- The team has local certified public accountants with an average of 17 years of experience.

- We’ll take bookkeeping off your plate so you can focus on the more important parts of the business while we handle the complexities and nuances of Washington State taxes.

Services

We’ll work with you to connect accounts and pull the data we need to reconcile your books. Our team takes the time to deeply understand your business, answer your questions, help you link your accounts, and show you how Bench works. Jennifer helped to clean up my QuickBooks online and each month she provided a very clear Profit and Loss statement and Balance sheet.

Expertise.com Rating

She took time to explain everything so that I understood the information and then could make good business decisions, saving money and strategizing how to increase my profits. https://www.bookstime.com/ Schedule a free, no-hassle, no-obligation consultation with us and find out how much time and money we can save your Seattle-based business today. Say goodbye to piles of paperwork and time-consuming manual tracking—we automate inputs directly from linked accounts. Get insights from one central dashboard so you can easily understand the health of your business and make strategic decisions.