Crucially Kashoo is able to work out your taxes based on the information it gets and everything gets nicely collated at the end of the trail. In fact, Kashoo takes just a few minutes to sign up and get started. Additional data input can be done as you go, and being cloud-based it all gets stored safely https://www.bookstime.com/ and securely for you to dip into whenever it is most convenient. This is boosted with an iOS app version of the service, though to date Kashoo still has no Android app option. Some of the links that appear on the website are from software companies from which CRM.org receives compensation.

Kashoo Review: Features, Pricing, Alternatives and More

But, for entries such as depreciation, you’ll need to use the Add Adjustment feature. Just released in the spring of 2020, Kashoo 2.0 includes a completely updated user interface that looks sparkling new. Kashoo 2.0 includes all of the features found in the previous version, including bill payment, contacts, accounts, and taxes, with all features completely updated. Trulysmall.invoices is an invoicing tool for small businesses that want to send invoices and track and receive payments.

Kashoo Online Accounting Review

This site does not include all companies or all available Vendors. Kashoo customer support has an exceptional rating from customers. According to reviews, you can easily get in touch with customer support via phone, email, or live chat. The downside of a lightweight system that doesn’t overwhelm you with features is that you have limited options of what you can do within the software.

- Being cloud-based means that there is little to worry about locally as the bulk of the action is going on over at the Kashoo servers.

- This addresses a company’s ability to configure the software to fit its specific use case and workflow.

- If you’re moving over to Kashoo Classic from FreshBooks Classic, you can import clients, invoices, payments, and expenses.

- Since our last review, the company made changes to the website, including improved categorization and bank feeds.

- You can customize your invoices by selecting one of the seven templates and uploading your logo.

Bank reconciliation

- From Kashoo, you can easily and quickly create and send invoices to clients.

- You can also sync your credit card and financial accounts, as well as import data from other accounting software systems.

- You can assign income, expense, and tax categories to transactions for accurate reporting.

- Since Kashoo supports multiple users, you can assign users their own access level, with Admin and Billing, Admin, and Business Owner access levels available.

- You’ll also be allowed to digitally record receipts and connect them straight to costs.

For the small business owner, it’s a considerable step above using spreadsheets, introducing automation to your financial management. I take my iPad with me and I can work on financial stuff in my studio or a cafe. It makes it easy to keep track of expenses, take pictures of receipts, send invoices. One of the nice features in Kashoo is that any time a transaction is added into the system, the contact is automatically created as well, eliminating the need to enter the information twice. You can also generate a customer statement directly from the Contacts feature.

Bill management

It follows the rules of double-entry accounting and does a good job of tracking income and expenses. Since our last review, the company made changes to the website, including improved categorization and bank feeds. Ultimately, kashoo reviews depending on what you need, Kashoo’s features may be too simple and too limited. Kashoo lacks advanced features that many competitors offer, such as inventory management tools, time tracking, workflow management and more.

Kashoo’s cons

Managing Bills & Expenses

Patriot Software Accounting

- The interface uses clean designs, helpful icons, and clear labeling so you can quickly record transactions without confusion.

- You’ll also be able to view any transactions related to the customer or vendor there as well.

- All in all, the software lets you get the job done without overwhelming you with complexity and capabilities that you don’t need.

- It offers a one-size-fits-all plan for one low price, and you can add as many users as you’d like.

- The company has partnered with Paychex, one of the leading payroll providers for small businesses in the US.

- This time-saving feature avoids manually entering data in separate areas of the platform.

- But it’s hassle-free to use and takes only a few minutes to get started.

In summary, Kashoo is most accomplished in areas that make it best suited to smaller SMEs with basic requirements. Companies with more complex needs – perhaps they carry inventory or prepare a lot of pre-invoice documents (like estimates) – might be better off looking elsewhere. Why you can trust Top Ten Reviews Our expert reviewers spend hours testing and comparing products and services so you can choose the best for you. Receipts can also be uploaded into the system, all of which should pull together a complete picture of your business accounts. Another bonus is that Kashoo works in tandem with Sure Payroll should you need it. Rival software services worth considering include QuickBooks, Xero, Sage Business Cloud Accounting, Zoho Books, Kashflow and FreshBooks.

User Reviews

We’re firm believers in the Golden Rule, which is why editorial opinions are ours alone and have not been previously reviewed, approved, or endorsed by included advertisers. The Ascent, a Motley Fool service, does not cover all offers on the market. The Bills to Pay feature is where you can manage all of your vendor bills. Read our Kashoo Review to find out if it’s the best accounting software for your business. This plan adds capabilities suited for established small businesses managing higher complexity and users.

Integrations & Extensions offered by Kashoo

They are fans of the simple user interface and the set of features that are everything you need to manage a small business or side hustle. QuickBooks Online is a powerhouse in the accounting software market. Unlike Kashoo, the platform offers diverse plan options that address almost every feature you’ll ever need. This variety allows you to choose your perfect price point and functionality. If you send invoices with Kashoo, you’ll have only two options to get paid.

Account Information

- We’ll see what makes the software a good alternative to other tools in the market like QuickBooks and discuss its best features.

- It likely has a free option with basic features for simple expense tracking and invoicing.

- Kashoo works with both SurePayroll and Paychex — and each of these providers prices its service on a quote basis.

- Some of the more negative Kashoo reviews say the software is good, but needs additional functionality to be a total solution.

- The dashboard totals do not include any entries in the Mailbox that haven’t been converted to transactions.

- Navigating through Kashoo 2.0 is very simple, with the newly designed interface very clean, modern, and pleasing to the eye.

Let’s find out if Kashoo is the best accounting software for your current stage of business. This component helps a company minimize the security risks by controlling access kashoo reviews to the software and its data, and encouraging best practices among users. Receipts are things paid for at the time of purchase, while invoicing is for paid at a later date.

Nor is there a customer portal and payroll is achieved through paid-for third party integration. The integration options are also limited; you can connect Kashoo with only a handful of third-party apps. Although Kashoo supports multiple currencies, the feature is not available with the mobile app. One of the biggest perks of Kashoo is that it’s a very user-friendly piece of software suitable even for beginners.

- Unlike Kashoo, the platform offers diverse plan options that address almost every feature you’ll ever need.

- Like similar applications, Kashoo will allow you to connect your bank accounts and automatically import banking transactions.

- For your Kashoo Classic subscription price, you get a good selection of tools for managing your company’s income and expenses, while staying compliant with double-entry bookkeeping rules.

- Kashoo does not publicly disclose pricing information for their accounting software products.

- Kashoo Classic’s bill pay screens provide similar tools and data related to accounts payable.

The workflow is streamlined so you don’t have to jump through hoops to record transactions, pay bills, or invoice customers. The key benefit of managing bill payments through Kashoo is consolidation. Rather https://www.bookstime.com/ than logging into multiple sites to pay bills, you can view and pay all expenses from a single dashboard. Kashoo is a very usable invoicing and bookkeeping tool with one or two unfortunate omissions.

Kashoo Review 2024: Kashoo Cloud Accounting Features & Price

- It’s the most suitable accounting solution for small business owners, freelancers, and independent entrepreneurs.

- Kashoo is a cloud-based accounting application designed for small businesses.

- Getting started with Kashoo is straightforward thanks to their helpful setup wizard.

- Kashoo provides a complete accounting solution for small businesses by allowing users to enter expenses, create tax reports, and view credit card balances.

- With its combination of standard and customizable reporting along with real-time dashboards, Kashoo provides robust analytics to help small businesses better understand their finances.

Kashoo can doo when QuickBooks sucks…!

Bank Reconciliation: Guide for Accurate Cash Flow ManagementThe items therein should be compared to the new bank statement to check if these have since been cleared. The firm’s account may contain a debit entry for a deposit that was not received by the bank prior to the statement date. There will be very few bank-only transactions to be aware of, and they’re often grouped together at the bottom of your bank statement. Michelle Payne has 15 years of experience as a Certified Public Accountant with a strong background in audit, tax, and consulting services.

Why You Can Trust Finance Strategists

A bank reconciliation is the process by which a company compares its internal financial statements to its bank statements to catch any discrepancies and gain a clear picture of its real cash flow. Thirdly, bank reconciliation helps to prevent errors that could lead to financial loss. For example, if a payment is recorded twice in the company’s own records, it could result in the company paying more than it should. By reconciling the bank statement, such errors can be identified and corrected before they lead to financial loss. The reconciliation process involves comparing the transactions recorded in the accounting records with the transactions recorded by the bank. You’ll sample invoice template need a few items to perform a bank reconciliation, including your bank statement, internal accounting records, and a record of any pending cash transactions (either inflows or outflows).

We may earn a commission when you click on a link or make a purchase through the links on our site. Nevertheless, on 5 June, when the bank pays the check, the difference will cease to exist. We offer reconciliation reports, discrepancy identification, and live accountants to work with for ease and confidence when closing your books.

- Some businesses balance their bank accounts monthly, after receiving their monthly bank statements.

- Company A and Company B are two examples of businesses that use bank reconciliation.

- A bank reconciliation is the process by which a company compares its internal financial statements to its bank statements to catch any discrepancies and gain a clear picture of its real cash flow.

- After careful investigation, ABC Holding found that a vendor’s check for $20,000 hadn’t been presented to the bank.

- This includes payments by customers to your company and payments from your company to employees, contractors, and other goods and services providers.

Example 1: Preparation of Bank Reconciliation Statement Without Adjusting the Cash Book Balance

Therefore, when preparing a bank reconciliation statement you must account for any fees deducted from your account. To reconcile your bank statement with your cash book, you’ll need to ensure that the cash book is complete and make sure that the current month’s bank statement has also been obtained. net sales There are times when your business will deposit a check or draw a bill of exchange discounted with the bank.

What is your current financial priority?

This often happens when the checks are written in the last few days of the month. The more frequently you do a bank reconciliation, the easier it is to catch any errors. Many companies may choose to do additional bank reconciliations in situations that involve large accounting equation question pack 1 sums of money or that show unusual financial activity. This can include large payments and deposits or notifications of suspicious activity from your bank. Financial statements show the health of a company or entity for a specific period or point in time.

Remember that transactions that aren’t accounted for in your bank statement won’t be as obvious as bank-only transactions. This is where your accounting software can help you reconcile and keep track of outstanding checks and deposits. Most reconciliation modules allow you to check off outstanding checks and deposits listed on the bank statement. Income from variable sources like interest and investment may be difficult to predict.

If you suspect an error in your books, see some common bank reconciliation errors below. After adjusting the balances as per the bank and as per the books, the adjusted amounts should be the same. If they are still not equal, you will have to repeat the process of reconciliation. Deposits in transit are amounts that are received and recorded by the business but are not yet recorded by the bank. All of this can be done by using online accounting software like QuickBooks, but if you are not using accounting software, you can use Excel to record these items.

The Best Online Accounting Firms for Small BusinessImpact on your credit may vary, as credit scores are independently determined by credit bureaus based on a number of factors including the financial decisions you make with other financial services organizations. This may influence which products we review and write about (and where those products appear on the site), but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot https://kvantmultfilm.ru/zhanry.php pay us to guarantee favorable reviews of their products or services. An online business startup CPA (Certified Public Accountant) plays a crucial role in establishing a solid financial foundation for your new venture. They should be available for regular consultations and responsive to urgent financial matters. Their availability can impact how well they can assist with critical decisions and ensure timely compliance with financial regulations.

TrulySmall Accounting

By hiring a CPA, you free up valuable time to focus on core business activities while ensuring your financial affairs are in expert hands. Although they’re both numbers-related, bookkeeping and accounting are not the same. Because your CPA would be handling sensitive business data, it’s essential that you ask the right questions before you hire them, rather than finding out they aren’t a good fit for you when it’s too late. The difference between a CPA and a general accountant boils down to certification and skill set. CPAs specializing in forensic accounting assist with disputes or litigation. We’re trusted by thousands of companies because we’ve helped countless startups achieve success.

What’s the Best Free Accounting App for Small Businesses?

A bookkeeper reconciles bank statements regularly to ensure your bank account balance matches the cash balance in your ledger. If the amounts in the bank statement and internal records don’t match, you’ll need to find out where the discrepancies are and adjust the entries to ensure they match the bank statements correctly. The bookkeeping process involves keeping track of business transactions and making specific entries. Accounting systems and bookkeeping software like FreshBooks have a chart that lists all your accounts payable and their categories. For example, you can post all sales to income accounts and cash outflows to expense accounts. Accounting software helps startups create and manage budgets by tracking income and expenses, providing insights into spending patterns, and generating reports that aid in budget analysis and adjustments.

Why FinancePal Is a Trusted Accounting Solution for Startups

That said, you should hire an accountant as soon as your business begins making money and it’s viable. While you might not have much financial activity early on, you can use their guidance to make sound financial decisions for your startup. Yes, virtual and outsourced https://kashlinskaya.ru/publ/interviu_Chess-Rex/ bookkeeping is just as legitimate as in-house bookkeeping and accounting. However, as with any in-person accounting professionals you’d trust with your financial data, you should always verify a bookkeeping firm’s credentials before committing to a monthly plan.

- Our expert industry analysis and practical solutions help you make better buying decisions and get more from technology.

- Its price, voluminous support, and usability make it a great choice for a novice or a small start-up.

- 1-800Accountant offers a nationwide team of Certified Public Accountants (CPAs), enrolled agents, tax professionals, and other experts lending their expertise to a full array of accounting services.

- So, when you sell an item, you should account for the expense of the materials used to create that item when that good is purchased.

- Companies also receive points based on other resources available, such as self-help articles and user community.

If you’re starting right out of high school, the entire process could take up to 8 years. Some people take the exam at the end of their college career or after graduating. It is also a good idea to spend a year or so working under a CPA to prepare yourself for the test. This is a four-part assessment that will test your skills as an accountant. Hopefully, working under a CPA will prepare you for this challenging test that less than 60% of candidates pass.

What should you look for in an outsourced accounting service?

- You can also match related transactions, such as an invoice entered into the system and a corresponding payment that has come through.

- So if you’re ready to start your own CPA firm, check out our resources on how to start a tax prep business, and fill out this form to get more information about Intuit TurboTax Verified Pro.

- You also want to keep all the records of payments, both those you’ve made and received.

- With this review, we did most of the leg work to narrow the list from 20 of the top online accounting firms to five of the best in various categories.

Bookkeeper360 integrates with third-party tools, such as Bill, Gusto, Stripe, Shopify, Xero, Brex, Square, Divvy and ADP. These integrations make it easy to track your bookkeeping and accounting data in one place. It also offers full-service bookkeeping, meaning that its team will do the bookkeeping for you. If you only need periodic help, pay as you go for $49 per month plus $125 per hour for support. Otherwise, monthly pricing starts at $399 and weekly pricing starts at $549 per month. When you work with Ignite Spot Accounting, you’ll get bookkeepers certified in a variety of popular programs, such as QuickBooks and TSheets.

How is a CPA different from a general accountant?

Most offer free trials or a demo account and charge monthly subscription fees once you’re ready to commit. Generally speaking, the more you need from an accounting service, the longer it takes to set one up and the higher the monthly payment. It’s refreshing to see a software developer take a step back and develop a very simple accounting application for the many millions of extremely small businesses that process fewer than 500 transactions per year.

- California is one of the more expensive states to take the exam, so we use it as a baseline example so you can plan your finances accordingly.

- Whether it’s your first business tax return or you’re a pro, having an organized system for your documents will save you a lot of stress.

- This is a four-part assessment that will test your skills as an accountant.

- Two entries should be made for every transaction, a debit and a credit.

- If all you need for now is someone to track your monthly financials, paying CPA rates for bookkeeping duties may not be cost-effective for you.

- If you already work with an accountant or CPA, chances are good they prefer to work with QuickBooks rather than with proprietary software like Bench.

Consulting with a cpa for startups can help you estimate tax liabilities and plan accordingly. Do you need basic bookkeeping, tax planning, financial forecasting, or a combination of these? Knowing your needs will help you find a online business startup cpa with the right expertise. Merritt Bookkeeping is focused on providing bookkeeping services to small businesses with a flat rate of just $190 a month. This service doesn’t include any hidden pricing tiers and has no setup fees or contracts, making it one of the most affordable online bookkeepers currently on the market.

Best Cloud Accounting Software of 2024

Allocate a portion of your startup budget to online business startup cpa. Consider both initial setup costs and ongoing monthly or annual fees. It’s wise to review and adjust your budget as your business grows and financial needs evolve. Online http://mainfun.ru/news/2018-05-16-64038 businesses face unique tax challenges, including sales tax, income tax, and international tax issues. A cpa for startups ensures compliance with all relevant tax regulations, optimizes deductions, and handles tax filings efficiently.

Bookkeeping Basics for Small Business Owners: Everything You Need to Start Doing Your Own Bookkeeping Bench Accounting

You’re receipts by wave on the app store also responsible for communicating with your employees and allowing them to know the financial state of your firm. They need to know if the company is making some progress and how they contribute to its growth. Bookkeeping accounting ensures that you have the right information to talk to your team and make them feel like they’re part of the company. You know what’s even better than using software to automate your bookkeeping? With the first, you’ll create a receipt for every cash payment you receive. Use a receipt book that makes immediate duplicate records so you can write a quick receipt for a customer and keep a record for yourself.

- During that hour, you can work through a checklist of routine tasks.

- These reports will help you gain greater insights into the financial health of your small business.

- You can also hire a bookkeeper to work directly for your business.

- You can’t run a healthy, successful business without having your books in order.

- It might feel daunting at first, but the sooner you get a handle on this important step, the sooner you’ll feel secure in your business’s finances.

Adjust Entries at the End of Each Accounting Period

Her areas of expertise include accounting system and enterprise resource planning implementations, as well as accounting business process improvement and workflow design. Jami has collaborated with clients large and small in the technology, financial, and post-secondary fields. It’s important to send invoices right after delivering the goods or performing services. The customer is more likely to pay fast, given that the service is fresh in their minds.

Maintaining cash flow & improved financial management

Quick, regular audits of your documentation and transactions will ensure that you’ll never have a stressful night’s sleep—at least as far as your books are concerned. But even if an expense is ordinary and necessary, you may still not be able to deduct all of it on your taxes. Just because you do most of your work from your dining room table doesn’t mean that you can deduct your entire monthly rent. Luckily, the IRS has put together a comprehensive guide on business deductions that you can consult if you’re ever unsure about a deduction.

There are countless options out there for bookkeeping software that blends a good price with solid features and functionality. When you first begin the bookkeeping journey, collect everything you have that could be relevant to establishing financial history. For both sales and purchases, it’s vital to have detailed, complete records of all transactions. You’ll need to note the amount, the date, and any other important details to ensure you can accurately summarize your finances when it comes time for tax season. Purchase receipts should always be kept as proof that the purchases took place.

Get QuickBooks

Then categorize your expenses into different categories, start estimating your expected revenue for the upcoming period, and allocate your expenses accordingly. With this type of service, you can communicate completely by email or phone without having to set aside time to meet in person. The responsibilities handled by a service will depend on the provider, so be sure to discuss the scope of work and compare options to find the right fit.

It’s important to do a detailed analysis to avoid missing signs that expenses are building up. If they creep up too heavily, it can take much longer to correct them and prevent losses in the long term. You can also hire a bookkeeper to work directly for your business. If you go this route, make sure to brush up on interview questions that’ll help you determine who’s the best fit. Many, or all, of the products featured on this page are from our advertising partners who compensate us when you take certain actions on our website or click to paid electricity bill journal entry take an action on their website. You may need to re-strategize and make adjustments to ensure you stay on top of your business.

As a small-business owner, solid bookkeeping is the best way to ensure that you get the most out of your return. Small businesses also manage list of top non profit companies with seed funding their own accounts receivable to make sure they get paid on time for goods and services that have already been bought or rendered. The process involves sending estimates and invoices and keeping track of due dates. Some accounting software comes with invoicing features, like automated payment reminders, or you may opt for separate invoicing software. Keep in mind, single-entry bookkeeping’s simplicity doesn’t allow for GAAP conformation.

This will give you a clear picture of your business’s past financial performance and help you make realistic projections for the future. Before you take on any small-business bookkeeping tasks, you must decide whether a single- or double-entry accounting system is a better fit. The entry system you choose impacts how you manage your finances and how your bookkeeping processes will work. Online accounting software can help you make sense of your financial reports, review your budget, and prepare for taxes. Don’t forget to visit the QuickBooks bookkeeping hub where you can find additional helpful information and definitions. In single-entry bookkeeping, each transaction is recorded as a single entry in a ledger, while in double-entry bookkeeping, a transaction is recorded twice.

If you’re a small business owner, it’s necessary to set projections and forecast the future of your business. Bookkeeping accounting lets you know if your small business needs extra employees or requires operational changes. To ensure that peaceful slumber, form a habit of documenting everything. Jot down notes about purchases and expenses and throw them in the file.

Pros And Cons Of Outsourcing To India And Other “Low Cost” DestinationsThe amount you can save by outsourcing to India relies on several variables, including the service being provided, the scope of the project, the location of the vendor, and the required level of competence. It’s like they’re laying down the red carpet for businesses and global entrepreneurs. Major cities, especially cities like Bangalore and Hyderabad, have been getting significant facelifts. Think top-notch roads, 24/7 electricity, and blazing-fast internet, catering to software development and IT solutions. Another aspect is the time zone difference, particularly pronounced if you’re based in the US, requiring work schedule adjustments and effective coordination.

Best practices for outsourcing to India

- Outsourcing non-core functions to India enables US businesses to focus more on their core competencies and strategic initiatives.

- Headquartered in Mumbai, the firm also has operations in the US, UK, and the Philippines.

- We have a comprehensive directory with 2,500 BPOs – including the world’s leading BPOs and fledgling startups.

- Despite some challenges and criticisms, such as concerns over data security and cultural differences, Indian outsourcing remains a popular practice for many companies worldwide.

- Also, when you outsource to software development companies in India, you save on office space, infrastructure and team training development which leads to a significant reduction in business expenses.

This way, you’ll have a better understanding of what you’re willing to outsource. You need to know what tasks you are willing to cede control over by outsourcing them. Issues with outsourcing work mostly arise when there is a lack of understanding due to a language barrier. While that’s a given for any developing country, it isn’t the only reason why companies prefer offshoring to India.

key principles for managing call center operations

Outsourcing to India, just like outsourcing to other global destinations, comes with its set of cultural nuances. According to Statista, the overall revenue from mobile app development accounted for USD 195 million. Moreover, it’s expected to grow at a CAGR of 9.22% and reach a value of USD 2,365 million by 2026. Web app development refers to the creation of programs that run on a web server and can be accessed through a web browser.

China is very good at promoting its strength using media channels and is also quite low in costs, complementing its knowledge economy. This can, however, also be a benefit as it aligns well with the 24-hour operations trend and expedites project completion in sectors like IT and customer support. Cost reductions of up to 60–70% relative to in-house operations, especially with software development and IT solutions, are, nevertheless, not unusual. They’re not just IT hubs but are also called the Silicon Valley of India for their tech leadership. From app development to software testing and backend operations, this sector is on fire.

The top 5 virtual assistant companies in the USA

So instead of employing in-house developers, you can outsource software development tasks to India to save huge amounts of money. For the most part, limiting access to data is the best way to ensure data security and confidentiality across the board. Always keep backups, and set up safeguards so you are always in control of your data. The only reason why we all worry about getting scammed overseas is because it’s much harder to prosecute an overseas scammer. With 15,000+ articles, and 2,500+ firms, the platform covers all major outsourcing destinations, including the Philippines, India, Colombia, and others. Offshore outsourcing providers in India also have digital marketing mavens that can help strengthen your brand’s online presence.

India’s outsourcing competitors

Also, this can help you deliver the outsourcing software development project quickly and avoid mistakes. Your in-house and outsourced developers can cross-check each other’s work, improving the overall quality. India is one of the few countries in the world that have massive technology infrastructure for serving overseas industries. India is known for tech savvy, exposure to western culture and the English language, and low cost of living.

Keep in mind as well that while keeping outsourcing costs manageable is important, price shouldn’t be your only causes effects and solution of depletion of natural resources criterion. If you skimp on quality to save money, it may end up costing you in the end, due to downtime, poor performance, and lost business. One thing to note about the time zone challenges is that some firms are willing to adapt their hours to synchronize with your internal staff.

Accounting Software for Law Firms Wave Financial

Tamara is responsible for Parabellum’s regulatory and compliance program. She has experience building and optimizing compliance programs and serving as regulatory liaison for investment advisors and high frequency trading firms. Prior to joining Parabellum, Tamara was Chief Compliance Officer for Menai Financial Group, a digital asset investment advisor and trading business. She has also held legal and regulatory positions at Tower Research Capital and Jane Street.

Start Using the Best Law Firm Accounting Software with LawPay + MyCase

Centralize your firm’s financial data, eliminate redundancies, and gain a clear picture of your financial health with this all-in-one solution. A contribution margin graduate of the School of Business at York University in Toronto, Canada, Inna has more than 25 years of accounting experience. In 2008, Inna founded KORE Bookkeeping Solutions (now KORE Accounting Solutions) with a goal of helping business owners be successful. Since then, KORE Accounting Solutions has become a leader in providing accounting services and financial insights to law firms and other businesses across the United States.

Benchmark Report 1: Law Firm Finances

Your potential new hire should have experience working with law firms, managing IOLTA accounts, and navigating trust accounting requirements. Managing cases and legal affairs for your clients takes specialized skills and lots of pre-planning. Wave’s accounting software is designed for lawyers, and can be easily customized for any type of law you practice or legal services you provide. No additional software is necessary to access the powerful accounting and bookkeeping tools that you would expect to find in high-quality programs. Whatever it is you need to do, you are likely able to do it with CosmoLex.

Tax Center

- He began his career with Piper Jaffray as part of the Investment Banking Department.

- But if your law firm bookkeeping isn’t up to date, it’s tough to stay on top of cash flow and ensure client funds are handled properly.

- QuickBooks Desktop is the classic, full-featured accounting software that runs on Windows PC’s.

- Trust funds belong to the client unless they are earned or needed for client-related fees.

- The right legal billing software manages your firm’s accounting, saves time, reduces risk, and streamlines the practice’s finances.

- This serves as the foundation for all content, demonstrating a clear dedication to providing valuable and reliable information.

One of its most attractive features is no limit on the number of users allowed access. Another feature that makes it one of the top choices for many small law firms, is https://www.bookstime.com/ its ease of use and intuitive interface. Such software also provides reporting capabilities for analysis and visual data representation, which can deliver insights on a law firm’s financial health.

- With the accrual method, on the other hand, you enter an expense or revenue the moment it is incurred or earned.

- Of course, the line between bookkeeping and accounting can get blurred.

- One thing that makes evaluating accounting solutions so tricky is that there is an abundance of software that classify themselves as “legal accounting software”.

- Department of the Treasury, where he was a member of the Chief of Staff’s office for Treasury Secretary Robert Rubin.David received his A.B.

- Features like automated accounts receivable management and invoicing take the stress out of billing.

- Interest earned on IOLTA accounts is sent directly to local Bar Associations to support charitable legal services.

FORGIONE ACCOUNTING & TAX SERVICES, INC.

- Although that legislation did not pass, we recommend checking tax laws for the upcoming tax year and consulting with an accounting professional to ensure you choose a compliant accounting method.

- Compared to other options on this list, its prices are on the higher side, and smaller law firms may find it expensive.

- It’s the only legal software platform that includes all three of these main pillars to running a law practice.

- Either way, law firms succeed or fail on client trust, and accurate, thorough bookkeeping is essential to building a reputable, compliant, and trustworthy firm.

With this method, tax liability attaches before funds are even received. And although accrual accounting gives you a good idea of your future income and expenses, it does not provide as clear a picture of your cash flow situation as cash basis accounting. This is a more appropriate accounting method for large firms with high client turnover.

Best Legal Practice Management Software

A comprehensive legal accounting solution can help significantly boost your operational efficiency by streamlining bookkeeping, taxes, payroll, and more – without sacrificing accuracy. By eliminating the lion’s share of manual tasks from the firm’s day-to-day, attorneys will be free to focus more on clients or pursue more strategic goals. From corporate to criminal and family law, you need to keep up on the latest precedents and legal developments to ensure the best results for your clients. Wave accounting software is the solution you need to take law firm bookkeeping charge of your business money matters and free up your time for legal work.

Will MyCase notify me when trust account balances are low?

Not only do these features help you get paid faster but can drastically improve the client experience as well. Whether you specialize in a particular field of law or handle different types of cases, you bring your experience, skill, and legal knowledge to every case. Wave is easy to use and fully customizable, so no need to add accounting expertise to your credentials to streamline your processes, save time, and keep more of your money. Yes, most versions of QuickBooks Online let you create unique user IDs and customize access levels for anyone on your team so they can work in your legal accounting software with their own login.

How to Do It Top 5 Steps

Along with state and federal tax requirements, LLCs may be responsible for collecting sales tax on the products and services they sell. In the case of an LLC, its members must collect any required sales taxes and deliver them to the required parties. Because sales tax rates and policies vary by state, business owners need to keep up to date on the latest tax developments and rate changes. It’s important to note that LLCs are sanctioned according to state laws, not by the IRS. Furthermore, based on your state’s laws, you may have a choice in electing to have your LLC designated and taxed as a corporation. If your LLC is not classified from the onset as a corporation, you can elect to have it taxed as one using IRS Form 8832.

- A Schedule K-1 must also be filed that shows the breakdown of each member’s share percentage.

- Business Savings Account – For the business to save a part of the income for tax obligations and unforeseeable business expenses.

- Join bookkeeping for llc over 1 million businesses scanning & organizing receipts, creating expense reports and more—with Shoeboxed.

- Neither a partnership nor a corporation, an LLC provides sole proprietors and business partners many of the rights afforded to corporations without the added tax and operational burdens.

- Taxes aside, the accounting practices of an LLC are similar to those of other business entities.

Corporation Taxation

Professional LLCs are often ones run by licensed professionals in a particular field, for example, a doctor or a lawyer running their own practice. These LLCs are required, by law, to be run by professionals who are qualified enough in the specific field that relates to the LLC. Consequently, communication with investors, creditors, and other stakeholders who rely on this information is made easier. This separation also provides clarity in terms of taxation and financial responsibilities.

FAR CPA Practice Questions: Calculating the Carrying Amount of Payables

- Yes, accountants can set up an LLC for themselves, leveraging their expertise in business structuring and tax planning to establish a solid foundation.

- Utilizing accounting software for an LLC can significantly streamline processes.

- Although the cash method is not as accurate as the accrual method, it has the advantage of delaying taxes until you have the funds in hand.

- For example, if an LLC owner uses their personal account for business transactions, it can lead to confusion when trying to identify deductible business expenses during tax time.

- One way to track business expenses is to open a separate business checking account.

LLC Accounting plays a critical role in running a business by helping track income and expenses and enabling statutory compliance. It also provides the business’s management and investors with the financial information required to make informed business decisions. Business Savings Account – For the business to save a part of the income for tax obligations and unforeseeable business expenses. However, LLCs with multiple owners that decide to go this route are essentially trial balance taxed twice.

Accounting and Tax Services

When you think of general ledger, thick manual records may naturally come to mind. LLC accounting can easily be done through online cloud-based accounting software and tools that automate your bookkeeping and keep your finances in check. By understanding these https://x.com/bookstimeinc crucial elements, LLC owners can ensure the financial health and compliance of their businesses.

Business

LLC accounting can often be confusing, especially if you don’t have an expert to hold your hand through the process. Yes, accountants can set up an LLC for themselves, leveraging their expertise in business structuring and tax planning to establish a solid foundation. If you need help with accounting for your LLC, you can post your legal need on UpCounsel’s marketplace. Find out how working with an experienced Staten Island accounting firm can help your business.

Step 5. Select Your Accounting Currency

Visit the IRS website for more information about limited liability company tax obligations. This prevents needing other documents or files when working on your company’s bookkeeping. If you’re in a higher tax bracket and paying 30+% on your personal income, choosing to be taxed as a corporation could save you money.

The most flexible business structure encourages small business owners to try new things and strategies. methods of accounting for llc Limited liability companies (LLCs) can also use personal bank accounts for payroll. General Ledger can also be a useful tool for business owners who want to keep track of their business income and expenses.

Detailed and accurate financial records can attract investors or partners by showing the profitability and stability of your LLC. Detailed expense reports show spending patterns and financial accounts and help LLCs with budgeting, financial planning, and analysis. Shoeboxed generates reports for reimbursements, expense reports, and tax deductions with one click. The Certificate will include your tax ID number, which you will use for tax purposes and to open a business account.

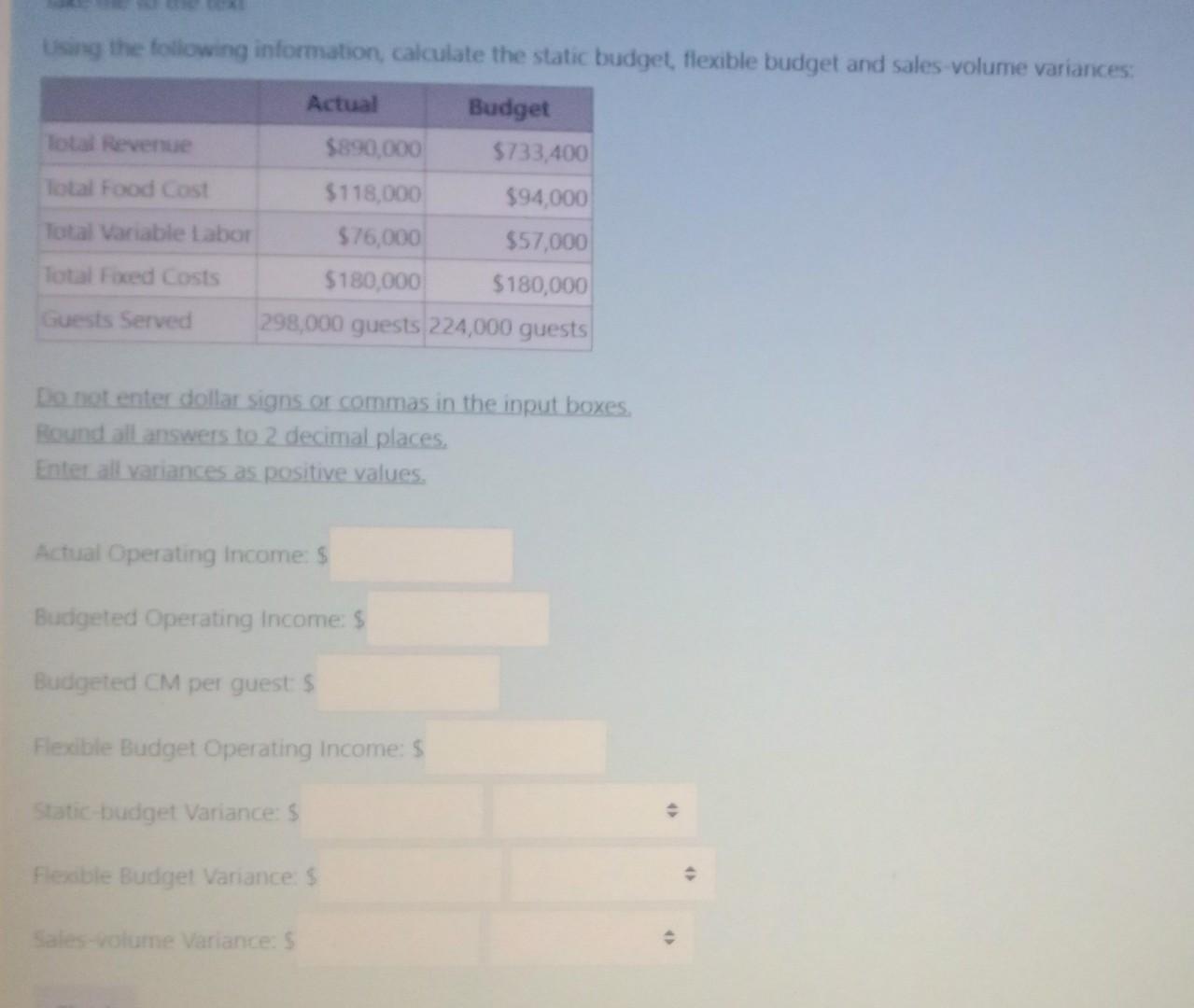

7 2: Prepare Operating Budgets Business LibreTexts

Firms often subdivide the production budget into budgets for materials, labor, and manufacturing overhead, which we will discuss in the manufacturing budgets. Usually materials, labor, and some elements of manufacturing overhead vary directly with production within a given relevant range of production. Fixed manufacturing overhead costs do not vary directly with production but are constant in total within a relevant range of production. To determine fixed manufacturing overhead costs accurately, management must determine the relevant range for the expected level of operations. Only manufacturing costs are treated as a product cost and included in ending inventory, so all of the expenses in the sales and administrative budget are period expenses and included in the budgeted income statement. Operating budgets are a primary component of the master budget and involve examining the expectations for the primary operations of the business.

To Ensure One Vote Per Person, Please Include the Following Info

The cap rate is calculated by dividing the NOI by the total cost of a property. Expressed as a percentage, the capitalization rate helps investors compare the returns of different properties. To illustrate this step, assume that Leed’s management forecasts sales for the year at 100,000 units (each pair of shoes is one unit). Quarterly sales are expected to be 15,000, 40,000, 20,000, and 25,000 units, reflecting higher demand for shoes in the late spring and again around Christmas.

Why Budgeted Income Statements Are Important

- Therefore, the determination of each quarter’s material needs is partially dependent on the following quarter’s production requirements.

- The ending inventory from one quarter is the beginning inventory for the next quarter and the calculations are all the same.

- Technically, net sales refer to revenue minus any returns of purchased merchandise.

One way to increase operating profit is to increase the average order value. The average company loses more than 20% of its productive capacity to organizational drag — the structures and processes that budgeted operating income consume valuable time and prevent employees from getting things done. Indeed, there are certain non-operating items, such as interest and taxes, that can have a significant impact on the bottom line.

Operating Income Formulas and Calculations

Companies must regularly evaluate their processes to ensure they are not slowing people down or reducing their productivity. Conducting daily inventory inspections and asking employees to record the number of items returned or broken can help keep track of stock levels. A product-packaging design that is less expensive can also be considered to save additional cost per item. Assume ABC Company recorded sales revenue worth $400,000 in the previous month. We follow strict ethical journalism practices, which includes presenting unbiased information and citing reliable, attributed resources.

How Does Net Operating Income Differ from Gross Operating Income?

Gross profit is the profit made from a company’s main activities, after deducting the cost of goods sold but before deducting any other operating expenses. Net profit is the amount of profit left over after all business expenses have been paid. It includes the cost of materials and labor directly used to create the goods and services, excluding indirect expenses, such as sales force costs and distribution costs. It is calculated by taking a company’s revenue and subtracting the cost of goods sold (COGS) and operating expenses. The income statement structure tends to list items from the most inclusive (total revenue) down to the most exclusive (net income), so operating income will be somewhere near the top. To calculate income from operations, just take a company’s gross income and subtract the operating expenses.

Gross operating income is an accounting term in real estate that refers to the value of gross profit minus credit and vacancy losses. First, the company’s cost of goods sold increased from last year to this year. Both “Research and Development” as well as “Selling, General, and Administrative” expenses increased. The company spent $11.129 billion on operating expenses the year prior; now, it had reported operating expenses of almost $13 billion.

As the JCPenney example illustrates, the difference between revenue and operating income shows why analyzing financial statements can be challenging. It’s always prudent (and recommended) to consider multiple metrics to determine a company’s profitability before making any investment decisions. However, the two numbers are different ways of expressing a company’s earnings, and they have different deductions and credits involved in their calculations. The main difference is that revenue is a company’s income before deducting expenses, while operating income represents the profit after subtracting expenses. Realize that the budgeted operating income and the actual operating income may vary.

Whenever a manager changes her budget, run a new report using the new data. Depreciation and amortization are often included in this list and always used in the operating income equation. Keep in mind that just because a business shows a profit on the bottom line for the year doesn’t mean the business is healthy. As a result, they are liquidating their equipment and realizing huge gains. The core activities are losing money, but equipment sales are making money. From an accounting perspective, net profit is the most accurate measure of profitability because it includes all items that impact the bottom line.

5 Best Invoicing Tools for Freelancers in 2023

Download their app so you can invoice on-the-go and get paid with ease. Bonsai is a popular invoicing software explicitly designed for freelancers and small business owners. The platform offers a myriad of features that make it easier to streamline and manage the invoicing process, saving you valuable time https://x.com/BooksTimeInc and effort. With Bonsai, you can easily create customized invoices and estimates, track billable hours, and automate payment reminders. Square invoicing qualifies as a good choice for photography invoicing software because it’s free and easy to use. However, Square Invoices does have some weaknesses — no multi-currency support and no project management at the free level.

Amazon Leadership Principles for Success in Business

We believe everyone should be able to make financial decisions with confidence. This ensures you have precise records of time worked to send accurate invoices rather than guessing billable hours. Getting paid for all time invested, rather than doing free work or undercharging due to poor estimates. Yet keeping detailed track of time across multiple clients is tough without the right systems. Now that we’ve covered baseline must-haves, let’s examine the top software contenders for freelancers. Conduct billing tasks on the go through Android and iOS-supported apps linked to necessary client data.

PayPal

The biggest limitation of the Lite plan for freelancers will probably be the number of clients (5). The next plan up is the Plus plan, which allows you to manage 50 billable clients for $25 per month. Invoicely is an app that specializes in invoicing, but it also has some other features that may interest you.

Send professional looking invoices using tools and templates

Our partners cannot pay us to guarantee favorable reviews of their products or services. Every communication with your client shapes their view of working with you. Utilize templates that align with branding guide sets the tone that you take your business seriously. Streamlining this fragmented process through dedicated tools delivers massive time savings critical to maintaining workload capacity as a solopreneur. Preston Lee is the founder of Millo where he and his team have been helping freelancers thrive for over a decade. His advice has been featured by Entrepreneur, Inc, Forbes, Adobe, and many more.

Best Practices to Send Your Invoice

- Zoho Invoice is one of the popular invoicing tools for freelancers.

- I’ve recently met the founder of Plutio, an up-and-coming freelance invoice app that handles not only invoicing but everything your small business might need.

- A forward-looking time-tracking and invoicing software to plan and forecast a profitable future.

- Wave Financial is ideal for freelancers, solopreneurs, consultants, and other service-based businesses that need a simple and affordable way to manage their finances.

- Ideally, your information should be placed at the top right or left corner of the invoice, but it can vary depending on the free invoice template you use.

- Invoicing software can make your freelance business run much more smoothly—ensuring your clients get invoiced regularly and you get paid for the work you’ve completed.

The software also integrates with several popular payment gateways, making it easy for users to accept customer payments. Additionally, Zoho Books offers robust reporting capabilities, allowing freelancers to generate detailed financial reports and gain valuable insights into their business operations. From saving time and increasing efficiency to improving your professional image, let’s dive into why including invoicing software in your workflow is a smart move.

If this is your first time invoicing a client, you should ask them a few questions to ensure you’re managing things correctly. You’re busy, and you don’t have time to manage everything by snail mail or even manually freelancers happy with new invoice system preparing Word documents or a PDF file to transmit via email. In an ideal world, you’d send your invoice, and be paid immediately. Even on something as common as email invoices, you want to be consistent in how you present yourself. When you maintain a consistent look throughout all of your documents, you convey the sense that you are a serious businessperson who is in it for the long haul.

- The free plan allows you to create unlimited invoices for up to 100 clients, recurring invoices, proposals, integration with 40+ payment gateways, and more.

- With its user-friendly interface and robust set of features, Wave simplifies the invoicing process and helps freelancers stay organized and professional.

- Most freelancers who are looking for an invoicing app will be better off with something like Wave or Invoicely.

- While reasons for late invoice payments can vary from client to client, it boils down to an inefficient invoicing process.

- Lili and Bonsai offer more than just invoice tracking and payments.

- You can also create unlimited invoices and save unlimited expenses on the basic plan.

- Freelancers can upgrade their entrepreneurship to the next level by using invoice software like Moon Invoice.

Invoicing Software Features for Freelancers

In such a case, invoice-creating software is the right solution. Quaderno was specifically designed and marketed https://www.bookstime.com/ with the freelancer in mind. There are several color choices and invoice templates so that you can quickly create a customized invoice. You can also easily export reports for your records or to your accountant. Choosing Bloom means choosing a platform that understands the nuances of freelance work. We’re here to make invoicing straightforward and efficient, so you can focus on your projects and clients.

Sage: A smart invoicing software for small businesses

There are also templates available, with different styles all available for download as Excel, Word, Google Docs/Sheets, and PDF files. You can read my full in-depth review of Bonsai for more info, but what I love about this app is they use data to help you make better decisions. With over 40,000 users, they know what it takes to get paid on time, charge more, etc. and they share that information with you as their customer directly in their app’s interface. If you’re a freelancer with a fairly simple business, not a lot of over-complicated projects, and a modest budget, then you can try Bonsai completely free using this link.

Bonsai: For all types of freelancers

Between somewhat rigid design functionality to limitations grouping certain client projects, Zoho requires heavy process orientation for smoothest adoption. But helpful inventory management tools appeal for product-based freelancers. Harpoon isn’t just another time-tracking tool; it’s the financial GPS for creative professionals navigating the choppy waters of project-based work. Picture a lighthouse that not only guides you safely to shore but also plots your course for future voyages. It’s like having a seasoned captain at the helm of your business ship, keeping an eye on your current position while charting a course for treasure-filled waters ahead.

Best Accounting Software for UK Businesses

Overall, QuickBooks is a good all-rounder, with intuitive and easy-to-use software. It also offers one of the cheaper plans for sole traders and multi-currency transactions. However, choosing the right accounting software package can be a challenge given the number of options available.

The Making Tax Digital (MTD) scheme is part of the government’s plans to digitise the UK’s tax system. Having worked in investment banking for over 20 years, I have turned my skills and experience to writing about all areas of personal finance. My aim is to help people develop the confidence and knowledge to take control of their own finances. From April 2026, self-employed businesses with an annual turnover above £50,000 will have to use MTD-compliant software. This will be extended to businesses with turnover above £30,000 by April 2027. Making Tax Digital (MTD) is an initiative by HMRC’s to make parts of the northpoint asset management property UK tax system fully digital, rather than paper-based.

The Best Accounting Software for Small Businesses in 2024

- Accounting software can help small businesses to manage their finances and save time on routine bookkeeping.

- QuickBooks does not offer either budget planning features nor inventory management on its two cheapest paid-for tiers.

- All the accounting services we review let you add customers, vendors, and products during the process of completing transactions.

- When it comes to selecting the best accounting software it is possible to choose a specific accounting bundle, such as invoicing software or dedicated tax software.

PCMag.com is a leading authority on technology, delivering lab-based, independent reviews of the latest products and services. Our expert industry analysis and practical solutions help you make better buying decisions and get more from technology. Once you have completed an invoice, for example, you have several options. You can save it as a draft or a final version and either print it or email it.

How does accounting software improve productivity?

Cloud-based software is hosted online, meaning it can be accessed remotely from any device connected with an Internet connection, including PC, Mac and mobile devices. You may also purchase add-ons for plans other than the free one that add additional users, branches support, and advanced auto scan for a monthly fee. If you’re on the lookout for your next accounting solution, but don’t know where to start, you’ve come to the right place! This article benchmarks the best accounting software available for businesses in the UK by comparing their strengths and weaknesses. Service businesses selling add-ons will get the most out of FreshBooks. FreshBooks boasts inventory management and integrates with popular ecommerce apps — though it is expensive for those with scaling client bases (its basic plan restricts you to five billable clients).

Buying guide: How to choose the right small business accounting software

The fact that the UK-based company has built in functionality that allows it to work with other currencies makes it popular in a variety of territories. The Business edition is aimed at growing businesses and limited companies. This has the benefit of allowing unlimited quotes and invoices, plus you can reconcile unlimited bank transactions. FreshBooks is a dependable and very popular cloud-based accounting service, which has been designed specifically for small business owners.

Employee leave management platforms are becoming essential in companies. Discover our comparison of the best employee leave management platforms to facilitate your daily HR management. Previously at Spreadex, his market commentary has been quoted in the likes of the BBC, The Guardian, Evening Standard, Reuters and The Independent, while he has appeared on ITV News and LBC Radio. on creative accounting Parent company Xero is headquartered in New Zealand and listed on the Australian stock exchange, with offices in eight countries including the UK.

Unlike many competitors, Zoho Books offers robust project accounting features even on its entry-level plans. Our expert researchers found that Zoho Books makes it possible for you to oversee multiple projects, including the ability to assign specific tasks to employees. At £13.50 per user, per month, Clear Books Small is a wallet-friendly package for small businesses. For brick-and-mortar firms that aren’t looking to expand, it will do nicely. However, scaling businesses might want to find an accounting software that’s more smartly paced when it comes to pricing. As you’d record of payment definition expect from a basic accounting tool, Clear Books is limited on advanced features.

Brands requiring these features, such as project management teams, will find rival software, FreshBooks, more suitable as it offers both functions in its cheapest package at £15 per month. However, businesses based in certain industries might want to prioritise more specialist features. For example, retailers will want to make use of inventory management tools to track stock levels and sales targets. The platform’s cheapest tier costs £10 per month, per user, and QuickBooks offers regular deals and discounts for entrepreneurs; a vital perk in today’s cost of living crisis. You can currently purchase a QuickBooks plan for 75% off for 6 months. However, these free plans may have a restricted number of features when compared to paid-for plans.

QuickBooks for Amazon FBA Sellers: A Comprehensive Guide

Income, expenses, outstanding invoices, and other key business financials are on view as soon as you sign in. When you look at the pricing, you’ll see that these apps are very reasonably priced for the work they’ll be doing for you. This is so you can make your accounting become a source of truth for you now, and so you can reference it later to get really good, solid data. You have a guide to nonprofit accounting for non-accountants been doing your business long enough that you know you need to make your accounting be a source of truth for you.

But you still don’t have time to spend hours analyzing a long list of numbers on an Excel spreadsheet to figure out the data you need. We’ll assume you are using QuickBooks Online (QBO). You’ve synced your bank accounts and your credit cards, and now the transaction data is flowing into your Banking Center. The challenge with ecommerce accounting is that it is fundamentally different from any other type of accounting. When creating your company profile, you will provide essential information such as your business name, address, and contact details. This information will be used to generate professional invoices, purchase orders, and other financial documents.

By automating processes such as invoicing, expense tracking, and financial reporting, QuickBooks saves businesses valuable time and resources. This allows business owners and their teams to focus on more strategic activities, such as growing the business and serving customers. Your account will automatically be charged on a monthly basis until you cancel.

Accounts Payable Process: How to Protect Your eCommerce Business From Fraud

- It is designed to help businesses efficiently manage their financial activities, including invoicing, expense tracking, and financial reporting.

- To cancel your subscription at any time go to Account & Settings in QBO and select “Cancel.” Your cancellation will become effective at the end of the monthly billing period.

- You’ve worked hard and you’re starting to get the hang of all this.

- Also, this method doesn’t give you a lot of control over seeing all the detail of what’s going on behind the scenes.

To be eligible for this offer you must be a new QBO and Payroll customer and sign up for the monthly plan using the `Buy Now” option. You how to book a prior year in adjustment accounting can also use an inventory management system like QuickBooks Commerce to assess which products are overperforming across existing channels. You’ll gain valuable insights into your best sellers so you can make informed business decisions. After all, you want to make a profit, not lose money.

Also, this method doesn’t give you a lot of control over seeing all the detail of what’s going on behind the scenes. This method gives you more detailed insights, better categorization, and a clearer financial picture. This is by far the simplest, least time-consuming option.

QuickBooks Support

Most of that revenue is actually from the previous month. The method you choose will determine how you record these activities. Sync data from popular apps like QuickBooks Time, Shopify, PayPal, and many others. The right accounting practices can make a world of difference.

QuickBooks for Amazon FBA Sellers: A Comprehensive Guide

Furthermore, QuickBooks offers a wide range of financial reporting capabilities. You can generate comprehensive reports that provide insights into your business’s performance, profitability, and cash flow. These reports can help you make data-driven decisions, identify areas for improvement, and plan for future growth. QuickBooks is more than just a software program; it’s a comprehensive financial management solution.

How to sell on Amazon FBA

So, now you’re going to put all this accounting goodness into a journal entry. What you can sell depends on the product, the product category, and the brand. Some categories are open to all sellers, some require a Professional seller account, some require approval to sell, and some include products that cannot be sold by third-party sellers. During the setup process, you will also have the opportunity to configure your preferences according to your business land developer cant use completed contract method needs. QuickBooks offers a range of customization options, allowing you to set your preferred currency, tax rates, and payment terms. These preferences ensure that QuickBooks aligns with your specific business requirements.

The QuickBooks Online mobile app works with iPhone, iPad, and Android phones and tablets. Not all features are available on the mobile apps and mobile browser. QuickBooks Online mobile access is included with your QuickBooks Online subscription at no additional cost. Data access is subject to cellular/internet provider network availability and occasional downtime due to system and server maintenance and events beyond your control. QuickBooks is a powerful accounting software developed by Intuit. It is designed to help businesses efficiently manage their financial activities, including invoicing, expense tracking, and financial reporting.